us germany tax treaty withholding rates

151 rows Description of Withholding tax WHT rates. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990.

The Federal Republic of Germany will reduce its withholding rate on dividends paid to United States portfolio investors on a non-reciprocal basis from 15 percent to 10 percent.

. In other situations withholding agents may apply reduced rates or be exempted from the requirement to withhold tax at source either under domestic law exceptions or when there is a. Consequently if a withholding overseas tax rate is higher. The USA has tax treaties with more than 66 countries that provide the taxation of foreign dividends at reduced treaty rates.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount. You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the. Argentina and the United States of America Limited double tax treaty covering air and sea transport.

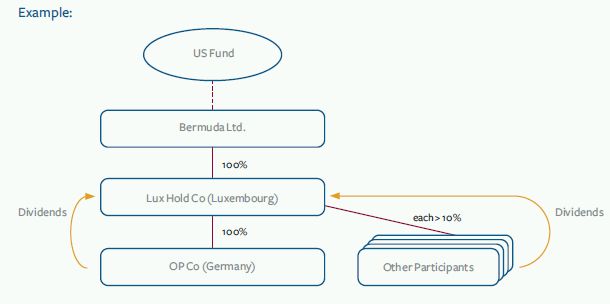

Germany - Tax Treaty Documents. 25 0 15 or upon application as reduced by EU directivedouble tax. Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD.

Tax Guide for Aliens and Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities. Implement the same withholding rates as footnote 3. 98 rows Detailed description of corporate withholding taxes in Germany Notes.

The purpose of the. The treaty has been updated and revised with the most recent version being 2006. This table lists the income tax and.

If you have problems opening the pdf document. Last reviewed - 01 August 2022. The complete texts of the following tax treaty documents are available in Adobe PDF format.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in. 62 rows Corporate - Withholding taxes. If a tax treaty between the United States and the foreign individuals payees country of residence provides an exemption from or a reduced rate of withholding.

On July 7 2015 the US. Germany and the United States have been engaged in treaty relations for many years. 10 2015 the Senate Foreign Relations Committee approved this treaty.

This simplified procedure is only applicable to licensors who 1 are tax resident in a treaty state ie a state with which Germany has concluded an income tax treaty. The treaty is not in effect. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the. Many of the individual states of the United States tax. The following countries have concluded double tax treaties with Malaysia.

The Federal Republic of Germany will reduce its withholding rate on dividends paid to United States portfolio investors on a non-reciprocal basis from 15 percent to 10 percent. Convention between the United States of. The purpose of the Germany-USA double taxation treaty.

Also see Publication 519 US.

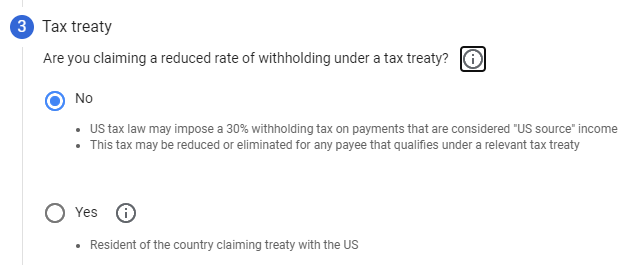

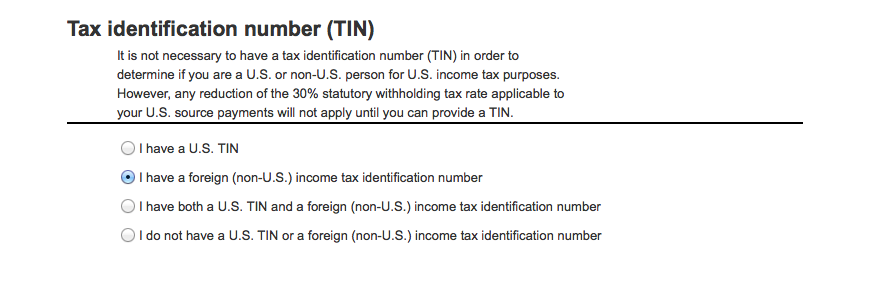

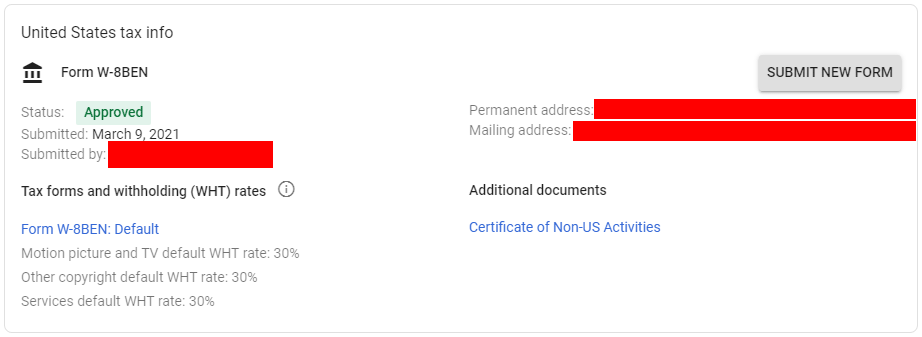

Avoid The 30 Tax Withholding For Non Us Self Publishers

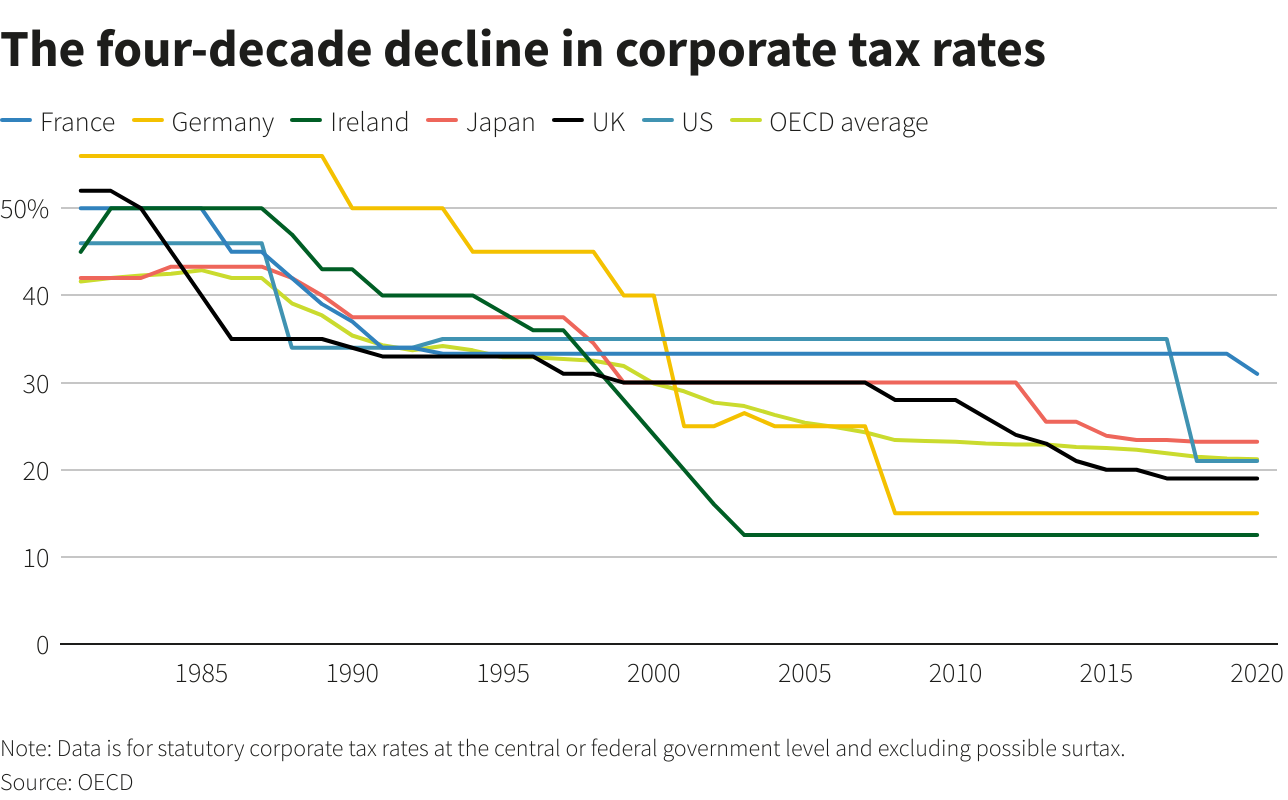

Double Taxation Of Corporate Income In The United States And The Oecd

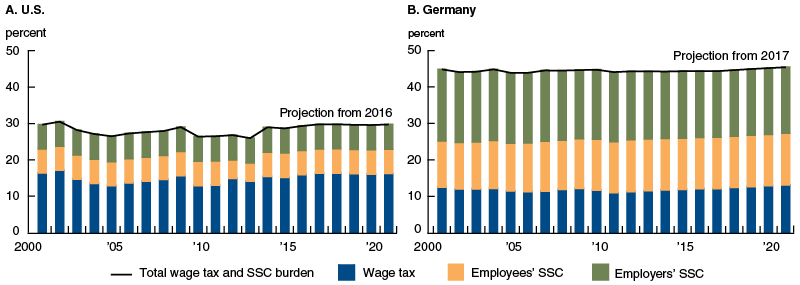

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

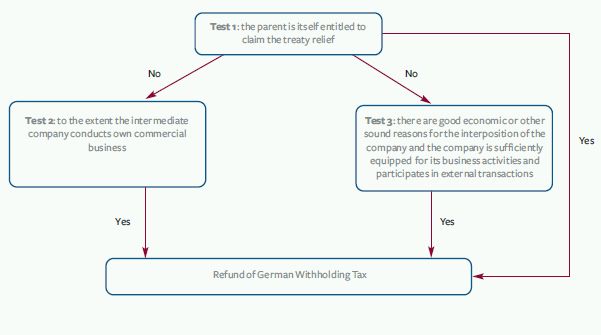

Refund Of German Withholding Taxes Good News For Foreign Investors Corporate Tax Germany

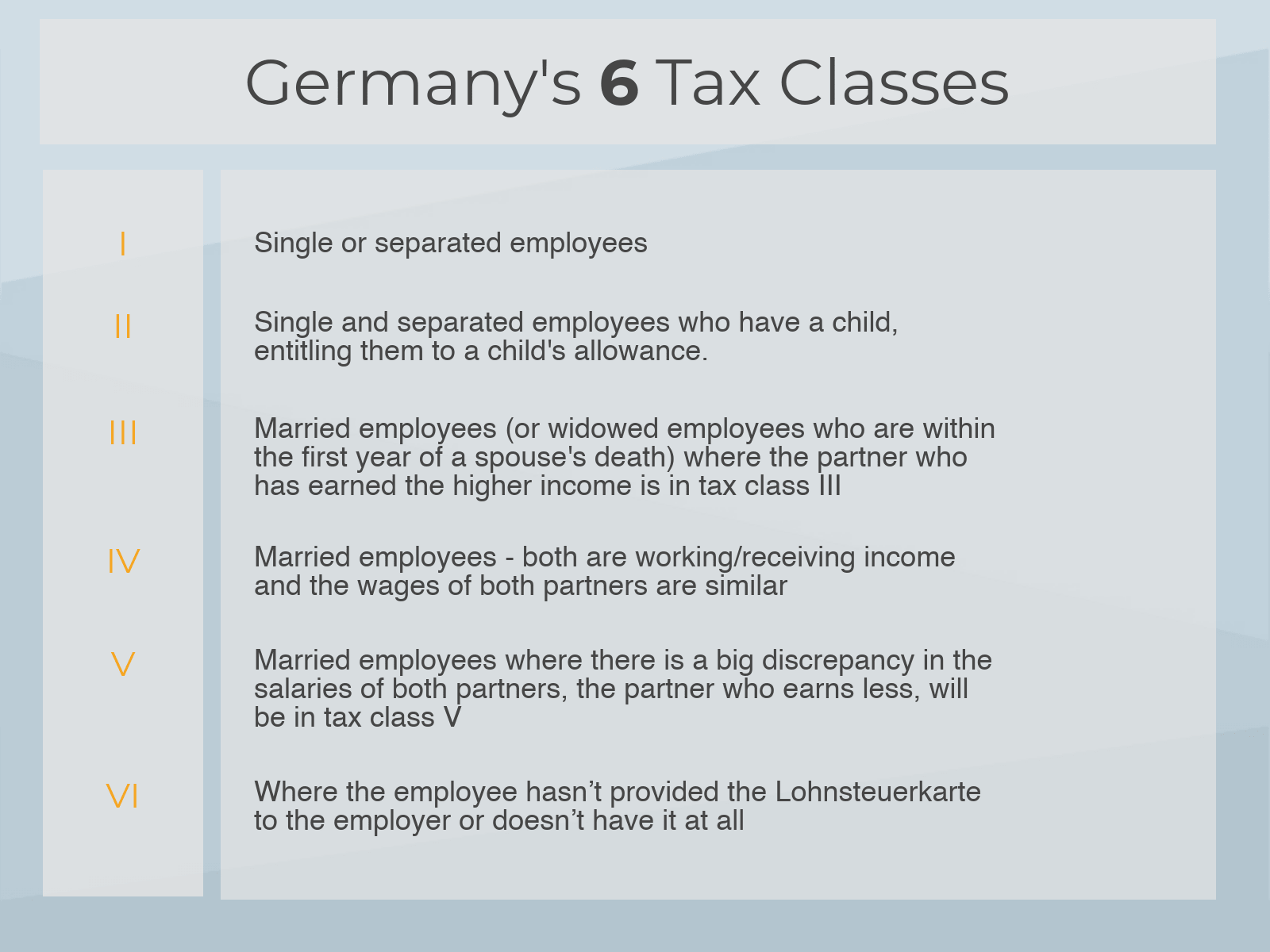

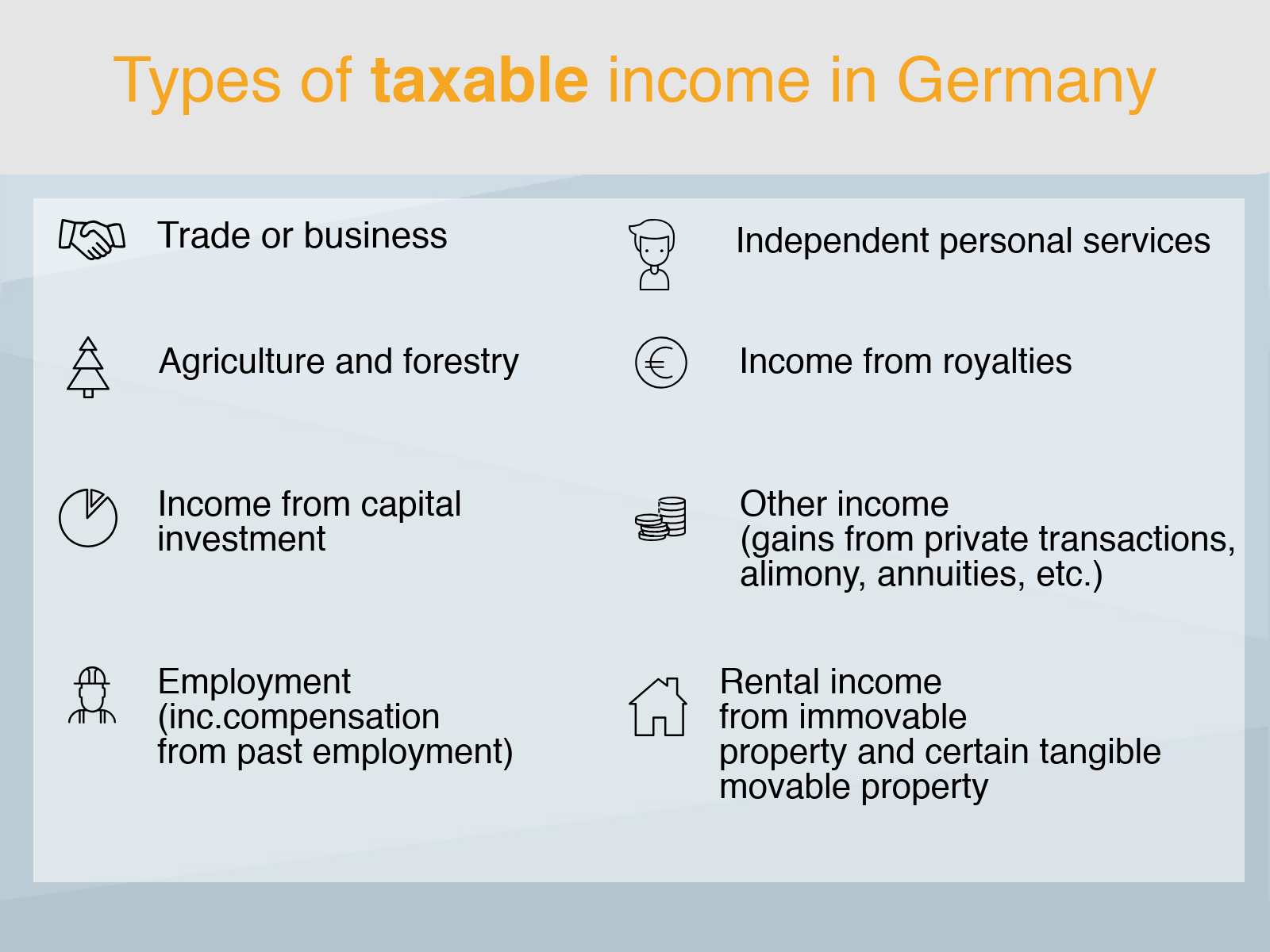

Your Bullsh T Free Guide To Taxes In Germany

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

United States Netherlands Income Tax Treaty Sf Tax Counsel

Filing Taxes In Germany As A Us Expat Protax

Youtube To Introduce Tax For Youtubers Outside U S Starting From June 2021 Tehnoblog Org

Tax On Us Royalties Self Publishing Adventures

Youtube To Introduce Tax For Youtubers Outside U S Starting From June 2021 Tehnoblog Org

Should The United States Terminate Its Tax Treaty With Russia

Spain Germany Sign New Tax Treaty Ernst Amp Young T Magazine

Refund Of German Withholding Taxes Good News For Foreign Investors Corporate Tax Germany

Withholding Tax Relief Ppt Download

Global Tax Deal Seeks To End Havens Criticized For No Teeth Reuters